What is MyVAULT?

MyVAULT is an exciting software product that’s designed to provide our clients with clarity in their financial world. Our community of clients crave a sense of order in their financial life – they needed something to remove the ‘noise’ and reduce the anxiety involved with managing personal finances in today’s busy world. Often time poor, we recognised that our clients needed a solution that delivers without the need for messy spreadsheets and constant work.

This platform isn’t a tailored solution for a specific group of people – we believe everyone has the ability to improve their finances and everyone deserves the clarity, organisation and the sense of purpose that this solution delivers.

How are our clients benefiting?

We’ve provided a fictional example based on an existing client, who we’ll call Penny:

Age: 28

Occupation: Software developer

Salary: $90,000 Plus Super

Current savings: $35,000

Marital status: Single

Key Goal: First home purchase – $500,000

Penny has some modest savings and has an active social life. She’s enjoying life in her late 20’s but understands if she’s to get ahead financially she needs to kick some financial goals. As part of this she needs to answer the ‘where does all of my money go’ question.

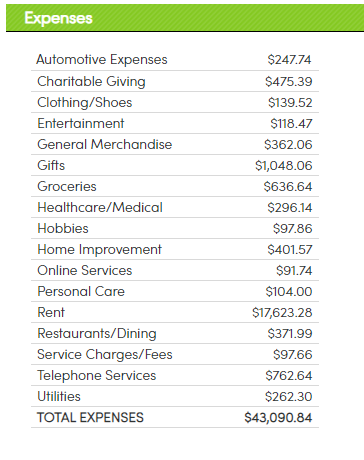

Penny starts using MyVAULT! After a short sign-on process her financial world is summarised on one page. She has the previous 12 months of transactions automatically downloaded and categorised.

Spending some time reviewing the past 12 months allows Penny to highlight some areas for improvement:

- She commits to a reduction of $50 per week from her ‘entertainment’ budget.

- She changes her internet service provider, reducing this expense by $35 per month.

- In understanding her car costs, she commits to using public transport 3 days per week.

- She decides to open a new bank account dedicated to long-term savings only. The new account requires 30 days notice for withdrawals and pays a very competitive interest rate.

- She begins pre-paying her regular bills each fortnight, committing $70 per fortnight to cover her estimated quarterly bills.

In completing several small changes to her fortnightly expenditure and restructuring her regular expenses Penny can add $125 per fortnight to her savings, without making big sacrifices to her everyday life.

After adding a ‘first home purchase’ goal in MyVAULT penny understands that she’s a little under two years away from having a 10% deposit.

While being comfortable with this timeframe Penny seeks some advice on how she might bridge this gap sooner, as she’d prefer to repay a mortgage than pay rent. After speaking with several experts and playing with her budget in MyVAULT, Penny has a great understanding of her options:

- Penny can ‘knuckle down’ and reduce her expenditure further, reducing the time period from 2 years to 18 months.

- Negotiating a salary increase with her employer of $5,000 will increase her annual savings and reduce the time period by a further 4 months.

- Penny understands she can afford the mortgage repayments now – she might seek assistance from her parents to borrow the deposit amount or to enter into a guarantor arrangement.

- Penny may consider a change in the way she invests, increasing the annual performance may allow her to buy sooner.

MyVAULT provides you with the knowledge you need to make financial decisions that activate your prosperity. To speak with a member of the MyVAULT team contact us on 1300 925 081 or simply navigate to the MyVAULT page, sign up and start making the changes today that will create the future you want.