Successful people use their budget like a fuel gauge. It’s the one dial that tells you if you’re going to make it to your next destination. Likewise, your budget should be able to tell you if you are on track to reaching your next goal. Spending your spare time entering and editing budgeting data is a thing of the past. With a few simple steps you can have accurate financial information at your fingertips.

“Not everybody who has a budget will be successful, but every successful person has a budget!” – Tim Hobart

We understand that in today’s busy world, financial freedom can seem a lifetime away. Yet by simply planning and taking a holistic approach to your finances, you’ll be amazed by the difference it can make.

If you’re reading this article you already understand that the first step in achieving an enhanced financial future is to make a plan. By having a budget and committing to this exercise you’re joining a community of people who are taking charge of their financial future. A community of people who are Activating their Prosperity!

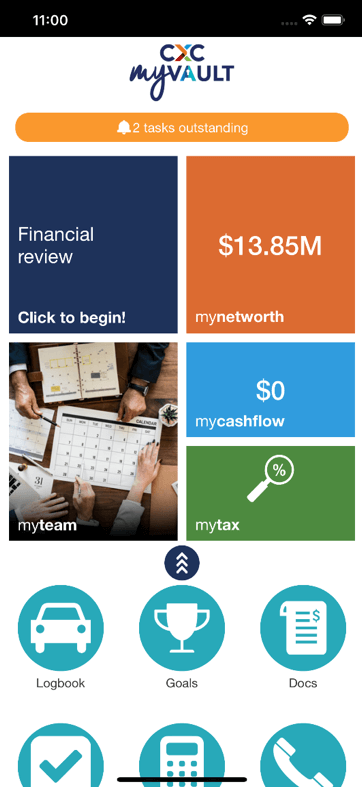

I want to encourage you to look closely at the Satori Advisory myVAULT App. It puts your budget in your hand, allowing to stay up to date with each and every transaction that is affecting your future.

In this document we’re taking an in-depth look at the budgeting functions within the App. We’ll provide an overview of our unique method of categorising transactions. We believe the insights you’ll gain in using this platform will make a significant change in your financial life.

When you use the myVAULT platform to categorise your bank account transactions, myVAULT uses the information to automatically allocate your transactions, it does the data entry for you. Now that’s a time saver!

Now we understand that everybody is a little different, so you can instruct myVAULT where exactly within your budget you want a transaction to go each and every time. You set the rules. Now that’s control!

Fixed Core Expenses

Fixed Core Expenses

These expenses are identified as fixed core expenses and include items like groceries, utilities, Automotive Expenses, Healthcare/Medical, Home Maintenance, Insurances, Personal care, Online services, Petrol/Fuel, Pet/Pet care and Transport.

Variable core expenses

These are expenses that you may not incur every week. Our experience tells us that these expenses have a considerable impact on your financials, so it’s important we understand their impact. It may be that special dinner, a special bottle of wine or a gift to friends and family.

Kids

We have created a separate category for expenses relating to children. For those of you who have them, you understand that they have a big impact on every aspect of your life!

Allocating child related expenses into core living may be your first instinct but we need to appreciate that these costs change as your child gets older. Childcare fees cease when school starts, private schooling fees can change each year and sport, or hobby related expense can be once-off or ongoing.

Roof over your head

Like the Kids category this “roof over your head” is often a core expense. We feel this expense is best isolated. Understanding this expense ensures you have accurate forward planning. As an example, if you are currently renting and hope to purchase a home, what impact will that have on your excess cashflow?

Transfers

Most people have multiple bank accounts. These internal transfers can unbalance even the most comprehensive budgets. Isolating these will ensure your balance sheet remains accurate.

Investments

The fun stuff! These categories identify activity relating to savings and or investing – your excess cashflow should be directed toward these areas.

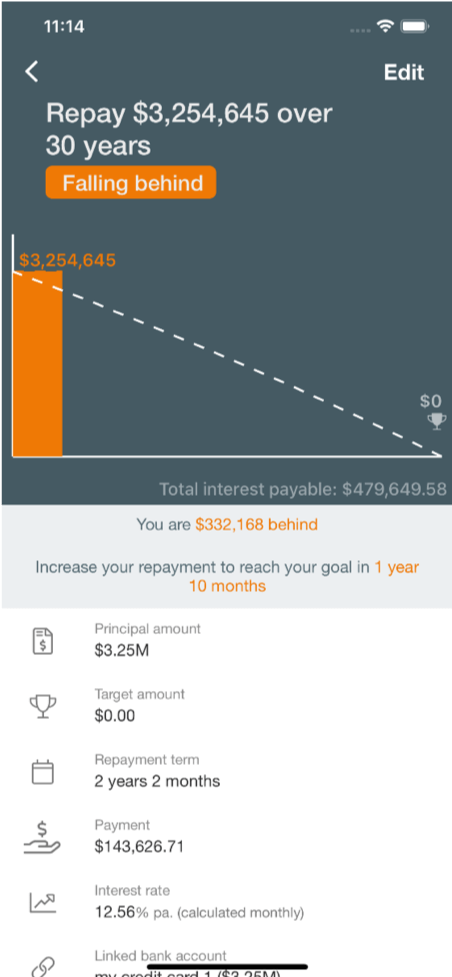

Tracking these transactions is key to supercharging your financial future. Combine this tracking with the goal’s functionality within myVAULT for a powerful experience.

Non-Core Expenses

Non-core expenses are primarily discretionary spending. Some may aim to reduce these expenses as a goal, while others may simply seek to understand the impact of these expenses on the future.

Here you will find One off large expenses, work related expenses, postage, Printing, Business costs, outgoing wages etc

Are you ready to get started?

If you’re ready to take control of your financial future, we’re ready to assist. With access to in-house experts in property, mortgages, tax and accounting, our holistic approach has your financial well-being covered. We’ll help you define your goals and prioritise what’s most important for your future.

If you would like to take control contact our team on 1300 925 081 or via our contact form for a no obligation and confidential discussion.