Financial Markets – Key influences on financial markets and strategies to adapt

For some years market commentators have been predicting a global economic downturn. Here we explore what’s influencing markets and provide some information on how to approach this possibility. With so much conflicting commentary and data circulating, we aim to bring some clarity to the key issues to focus on as you choose where to allocate your assets. We also explore what previous market downturns have looked like and how markets responded.

As this ‘doom and gloom’ commentary has become commonplace, many investors reduced their market exposure in favour of holding cash and term deposits and, consequently, have missed out on some stellar performance locally and overseas. The ASX 200 and MSCI World Index have both increased by over 20% since the beginning of 2019. While we are not against some investors staying with a conservative approach, it’s important that they act for the right reasons.

So what impacts investment performance?

There is a wide variety of influences on market and asset class performance. We’ve chosen our top 3 for this article:

Market Sentiment

The argument for market sentiment being the biggest driver is a strong one. In our current environment, it’s easy to believe that Donald Trump’s Twitter account is having a bigger impact on financial markets than economic data and Fundamentals combined.

Market sentiment refers to investor views on whether to buy an asset (positive view), hold an asset (neutral) or sell an asset (negative).

It’s fair to say that market sentiment in 2019 is negative or neutral and this view is formed largely from press articles and, to a lesser extent, the state of economies across the globe.

Market sentiment doesn’t impact investment values alone. As individual consumers and as business decision-makers, if we take a dim view on the short-term future, we tend to take a more conservative view on expenditure.

A negative market sentiment tends to slow key financial decisions such as buying a house, completing that house extension or buying the new car. This slows economic activity in general which in turn impacts interest rates as policy makers attempt to ‘shock’ the economy into action by lowering them.

Economic Indicators

Economic indicators such as inflation rates, employment rates, and interest rates have a major impact on the performance of all asset classes.

- The GDP or Gross Domestic Product measures the total market value of all domestic goods and services produced by a given country. The GDP is often viewed as a gauge of a country’s health and is used by policy makers to determine whether the country is expanding or contracting.

- Interest rates are also a good indicator of a country’s economic position and have a big impact on global markets. In more recent years, interest rates have been viewed as having an even bigger impact on markets as interest rates correlate to market performance. Some say it’s because rates are so low that we now do not worry about the repayments.

In some European economies, bonds are now paying negative rates. Across the globe, there is more than $11 Trillion invested in bonds with negative interest rates, meaning bond holders have to pay the issuer to hold the asset.

Investors accept this loss as they are seeking a haven for their savings.

Most central banks and governments are lowering interest rates and pulling other levers to activate the economy. The international monetary fund forecasts global growth at 3.2% in 2019 and 3.5% in 2020.

Fundamentals (research)

Fundamentals refers to the research involved with individual assets.

In the share market, analysts and investors will research individual businesses to determine the value of the business and the opportunities or threats to that business or sector.

Individual investors tend to complete lighter research when considering whether to buy/hold or sell shares in a business whereas fund managers, brokers and research houses will dedicate significant time and effort understanding every aspect of a business.

Active fund managers house teams of research analysts who dedicate their time to researching individual businesses. It’s not uncommon for an individual analyst to research a panel of only 5 companies over the course of their full-time employment.

The use of technology in this sector is also growing. The volume of algorithmic-based trading is increasing, with some investment products relying solely on the behaviour of the financial markets (such as volumes, prices or trends) to determine their next move. Many are concerned that this style of investing is eroding the viability of key fundamental analysis because the volume of such trading strategies is growing.

So what’s the approach for investors?

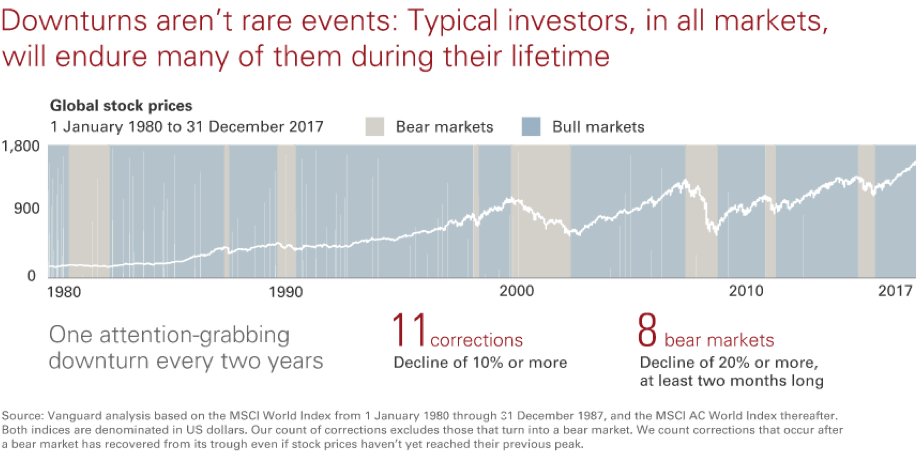

The simple truth is that nobody knows what the short-term future holds for investment returns. This 9 year run of strong performance might continue, or we may experience negative returns in our near future. We believe that making substantial changes to your investments (whether this be your super or personal investments) in anticipation of what you think may happen in the future makes it a little foolhardy. Why? It’s about timing. Getting the timing right is near impossible.

Peter Lynch, one of the most successful fund managers in the US, has a good quote on this: “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves.”

Let’s explore an example:

The above chart is provided by Vanguard Investments in the UK and, while it relates to the FTSE All Share Return Index, it illustrates the difference in the two strategies well.

- The chart compares the performance of a buy and hold strategy with a market timing strategy, which assumes an investor sells his or her portfolio after a 10% fall from the peak of the market and buys following a 10% rise from the bottom of the market.

- As can be seen, the buy and hold strategy significantly outperforms, turning the original £1,000 invested in 1985 into £7,000 by September 2018.

- By contrast, the market timing strategy would have turned it into £4,770. This translates into compound annual growth rates of 5.9% and 4.7% respectively.

What strategies should you consider to combat a potential downturn?

We feel the best approach is to ensure that each portion of your wealth is invested with a ‘fit for purpose’ approach. Essentially, have a plan for each parcel of your wealth. Make sure you truly understand your tolerance for risk and how much risk you actually need to take on, then apply the below framework:

- Short-term savings goals: 0 – 3 years (cars, holidays, school fees) should be invested in stable environments such as cash and term deposits.

- Medium-term savings goals: 3-7 years (first home deposits, investment properties) should gain exposure to assets that provide capital growth and income such as shares, fixed interest, and unlisted property.

- Long-term savings goals: 7+ years (Superannuation, building wealth and passive income) should have exposure to all asset classes, while keeping in line with your attitude toward investment risk.

Diversification is important!

Once you have identified your risk profile, risk needs and timing requirements, focus on diversification.

A diversified asset allocation strategy seeks to divide the total investible value across major asset categories. Each category contains assets that have different characteristics and often provide the investor with different outcomes.

The amount attributed to each asset class will depend on the needs and attitude of each portfolio and each investor.

A diversified portfolio can ‘even out’ the performance from a portfolio in a variety of market conditions.

In adopting this approach, you ensure the volatility involved with ‘riskier’ investments is only impacting your longer-term investments. You may experience negative returns for several years, but that’s ok – you have a plan and you know you can weather the storm. During periods of negative returns:

- you can try to make regular additions, purchasing these assets when the price is reduced and

- take advantage of investments yields that are often higher than current cash rates

In closing, don’t be reactive to markets and follow the crowd. Focus on understanding what you require from your investments and when, what your risk profile looks and be clear on what success looks like for you and your unique needs.

Contact Satori Advisory on 1300 925 081 or via our contact form for further information on your personal situation.

While every attempt has been made to ensure the accuracy of this information at the time of compilation, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors or omissions (including responsibility to any person by reason of negligence) is accepted by Satori Advisory, its officers, employees, agents or representatives.

All contents presented within this document are not to be construed as personal financial advice, taxation advice, a recommendation or an offer or invitation to buy, sell or hold a financial product. It is for general informational purposes only. These indicative investment fees, comparisons, and performance figures have been prepared without considering any personal objectives, financial situation or needs, and you should consider its appropriateness to your circumstances before acting on any of these representations.