This update is designed to provide you with a brief overview of financial markets in 2020 and an outline of key themes that may impact portfolio returns in 2021.

What happened in 2020?

The emergence of COVID-19 obviously dominated the news in 2020, but there were other historically significant events that occurred and that also impacted financial markets:

- Devastating bushfires in Australia and California

- Massive explosion in Beirut

- The (first) Impeachment of President Trump

- Death of George Floyd and the resultant Black Lives Matter protests

- Iranian ballistic missiles fired at military bases in Iraq, injuring American soldiers

- Brexit

- Summer Olympics in Japan cancelled

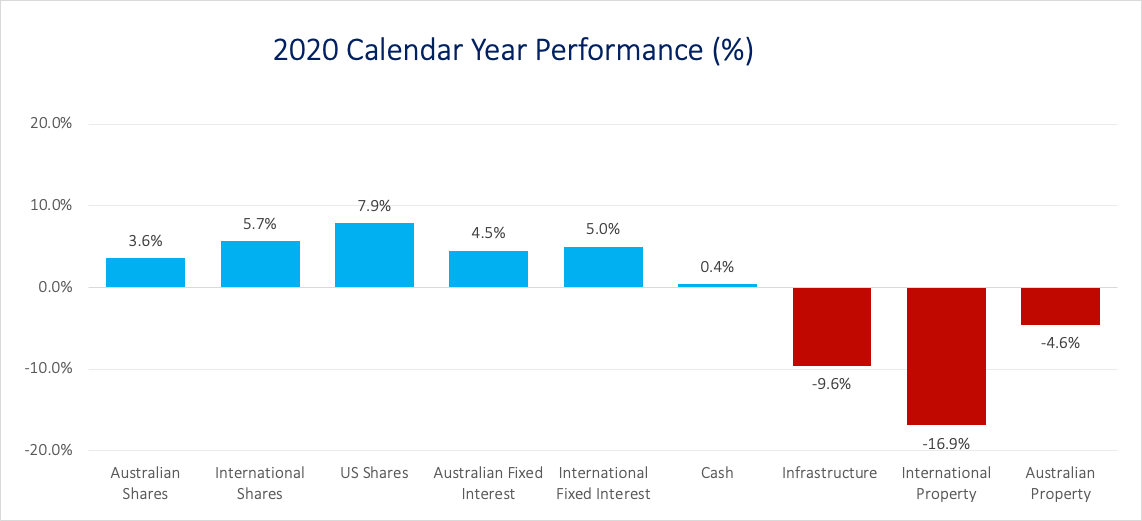

Despite the tumultuous year investment markets provided positive returns in most sectors:

Infrastructure assets were severely impacted by COVID as businesses operating in this space rely on the ability of people and businesses to move freely. Typical assets such as toll roads, ports and airports were locked down or heavily restricted so the ability of these assets to generate income was/ hamstrung.

Property securities focuses predominantly on commercial property such as warehousing, office spaces and logistics as well as retail property like Westfield – all of whom were hard hit in the 2020 environment and continue to be disrupted in 2021. The continued movement toward online shopping may decrease demand for retail shopping spaces and increase demand for warehousing and logistical solutions.

Strategy Tip: We anticipate these asset classes will recover as the world recovers from the virus. In the meantime our regular rebalancing activity will ensure that additional units in these assets are purchased while the value of the unit price is lower.

What’s in store for 2021?

The team at Vanguard Investments have summed this up nicely:

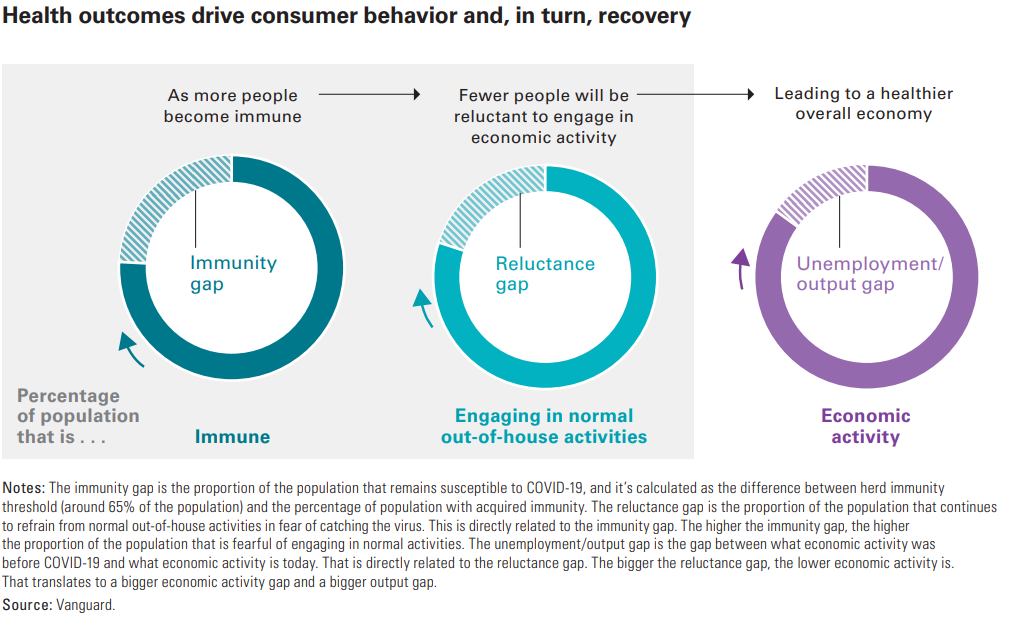

“In 2021, our outlook for the global economy hinges critically on health outcomes. Specifically, our baseline forecast assumes that an effective combination of vaccine and therapeutic treatments should ultimately emerge to gradually allow an easing of government restrictions on social interaction and a lessening of consumers’ economic hesitancy.

However, even with an effective vaccine in sight, the recovery’s path is likely to prove uneven and varied across industries and countries. It will be some time before many economies return to their pre-COVID levels of employment and output.”

To summarise, it’s likely we’ll have another year of volatility. While instability in markets can be concerning (and will certainly be monitored), we will continue to view this environment as an opportunity to take advantage of any opportunities that emerge.

Other themes in 2021

Property and the work from home revolution

With so many people transitioning to a work from home arrangement house prices in regional and coastal Australia are on the move. In some areas such as Noosa in QLD, house prices increased by almost 15% during 2020 and demand is increasing as more families and retirees move from Victoria and Sydney.

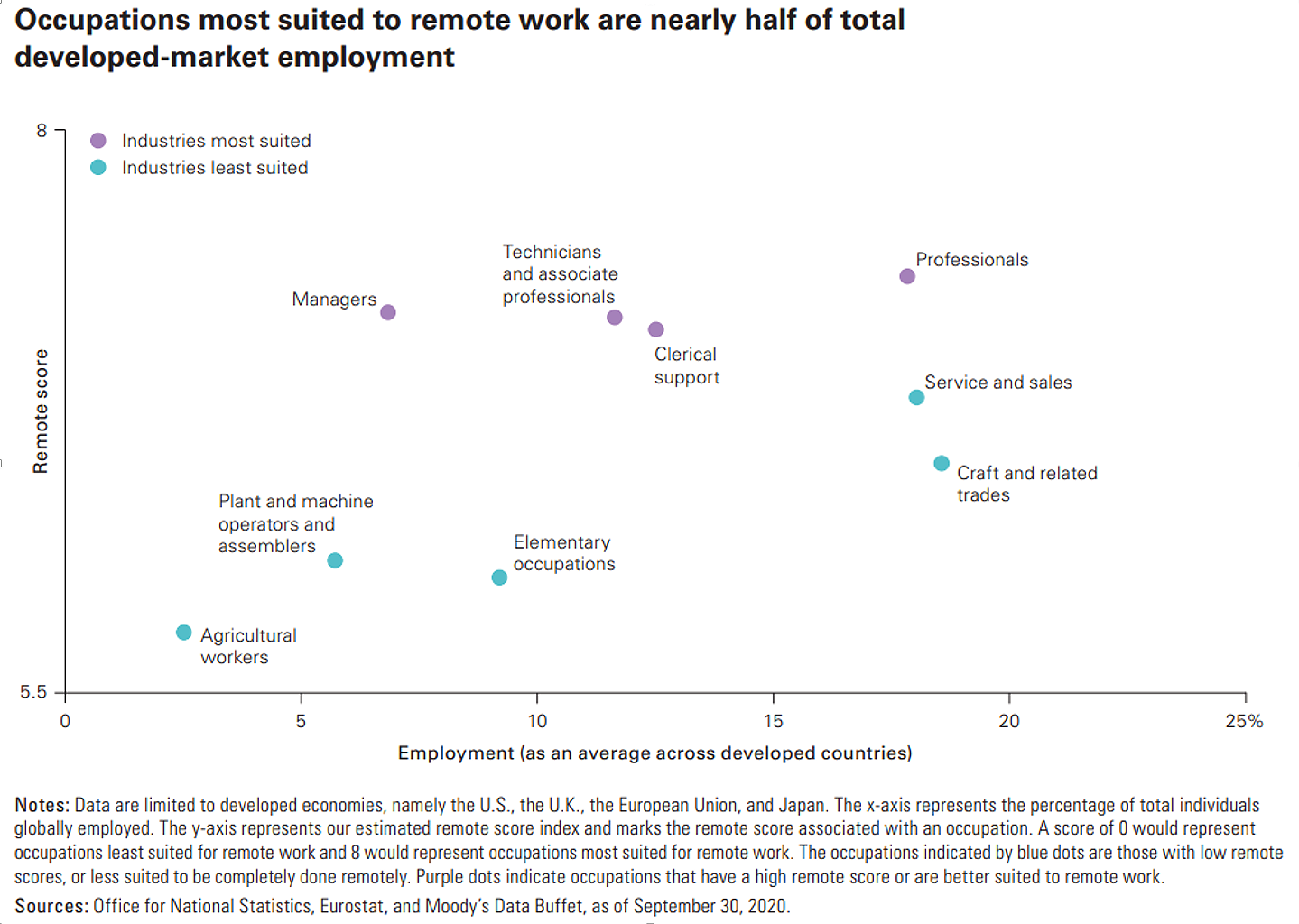

As the below graph shows, with occupations most suited to remote work now representing almost half of the developed-market employment, it will be interesting to see just how much of the city dwelling population will be dispersed throughout the country and the impact of this exodus.

Our relationship with China

While the impact of recent trade tensions has been largely offset by rising iron ore prices, China remains a concern for economists. Australia relies on the worlds second largest economy to purchase our exports.

Australian businesses are working to develop relationships with alternative markets to better diversify their sales across the world and decrease Australia’s dependence on China. Likewise, China are developing alternative suppliers for iron ore and other products to reduce their dependence on Australia.

The major threat to Australia is an escalation in the trade war. If China were to add coal, natural gas and iron ore to the list of affected agricultural exports it amounts to almost 6% of our GDP (Gross Domestic Product).

This seems unlikely however given the recent economic growth in China and the expectations of that growth continuing. A growing economy requires commodities and it’s unlikely China’s attempts to develop alternative suppliers will be successful in the short term.

The US

With Biden now installed in the White House we’d expect more stability from US Share markets, with less reliance on Trump’s regular posts on twitter to influence trading. That said, Biden’s challenge of uniting the US, combatting COVID and re-building international confidence in the country is not an easy one.

“It’s time to reward hard work in America – not wealth”. Biden’s economic policy is focused on increasing corporations tax and raising the minimum wage. Taking steps to combat stagnant or declining wages will translate to a healthier economy but not in the immediate term. Increasing minimum wages may have a counter productive impact, with employers less likely to hire new staff due to the increased cost. At a time when unemployment numbers are still high and as companies battle with the economic impact of COVID, Biden may be forced to take a longer-term view on these policies.

Another challenge for the new President, and one that will have a material impact on Australia, is China.

Trump’s presidency resulted in soured relations with Beijing. Biden might have used his new position to clear the air and engage in a fresh dialogue to improve China-US relations. So far this hasn’t occurred and the Presidents office seems to be taking a similar stance to Trump on issues relating to China.

Finally, there are market participants who predict a modest correction in the US share market, with potential declines in the realm of 5%-15%. Given the share market performance over the past 12 months and given the general view that mega cap stocks are overpriced, this would not come as a surprise.

In Summary

Despite the extraordinary challenges we faced in 2020 our portfolios managed to deliver positive performance across the board.

We’ve made some changes to the active manager allocations recently and these will be rolled out progressively in the first 6 months of 2021.

We remain committed to our targeted asset allocation approach and believe the next 12 months will be another example of the benefits of maintaining a well diversified portfolio.

If you have concerns about your portfolio, financial markets or volatility and the impact on you we’d recommend you get in touch with the team on 1300 925 081 or via our contact form.