In the past few years investors have poured billions of dollars globally into index funds. As an example, according to a New York Times article published in 2018, in the 3 calendar years leading up to 2017 roughly $823 billion was added to the Vanguard index fund range in the US alone.

In isolation this isn’t an astonishing figure, however when you consider the total inflow to the remaining mutual fund industry (being over 4,000 investment management firms) was only $97 billion combined we get a sense of just how popular the index fund approach is in the US. Australia is catching on.

So, what is an index fund?

An index fund is collection of assets that make up a specific index. A good example is the ASX300, made up of the top 300 shares listed on the Australian Securities Exchange (ASX) by market cap (total value of shares on issue). If you invested into a fund that tracks this index you are essentially investing in each of the top 300 companies in Australia. Your investment will be divided up according to the size of each business, with CBA being the largest at roughly 7%.

An index fund doesn’t rely on the expertise of investment managers and researchers to determine what shares to buy, sell or hold. It simply holds the shares within the index based on the size of the businesses.

So, what is an active fund?

An active fund will generally have a mandate to invest in a specific sector, or a range of sectors. The more common Australian Share funds will have the ability to invest in shares listed on the ASX. An active fund leverages the skills, expertise and experience of its employees to determine what specific shares to buy, sell or hold.

Active fund managers have teams of analysts and researches who dedicate their time to understanding the economy, the opportunities and the landscape. Their role is to advise the investment manager on what to (or what not to) include in his or her portfolio.

With all this energy dedicated to selecting assets it’s fair to expect that an active fund would outperform an index fund.

So why are so many flocking toward an index fund approach?

Investment performance:

- In Australia a staggering 86.69% of active fund managers failed to out-perform the index in the 2018 calendar year. This reduces slightly, to 85.81% over a 3-year period and reduces again to 79.61% over a 5-year period.

- In the US 63.46% of active fund managers failed to out-perform the index in the 2018 calendar year. Again, this reduces slightly to 78.64% over a 3-year period and reduces again to 76.49% over a 5-year period.

Source S&P SPIVA Scorecard.

Investment Fees:

- The average fee management fee for an active Australian Share Fund in Australia is roughly 1%*. This means for every $10,000 invested you’ll pay $100 in fees.

- As index funds don’t require teams of analysts, research or investment managers, the average management fee is under 0.30% and in some cases considerably lower. One of the largest, Vanguard’s Wholesale Australian Share Fund is 0.18%. This translates to an $18 investment fee each year.

*Based on fees as at 1 January 2018 for an initial investment of $50,000 for funds rated for the 2018 Managed Fund Star Ratings – provided by Canstar).

Powerful Diversification:

Investing in an index fund or an index ETF (exchange traded fund) allows you to deposit relatively small amounts and achieve exposure to a very large range of assets. Using the ASX300 as per the above example, a $5,000 investment would translate to a holding in 300 Australian businesses. Essentially, it’s unlikely you can achieve exposure to such a large range of shares when investing personally.

This diversification allows you to take advantage of the businesses who are succeeding whilst offsetting the potential for losses from the businesses who aren’t.

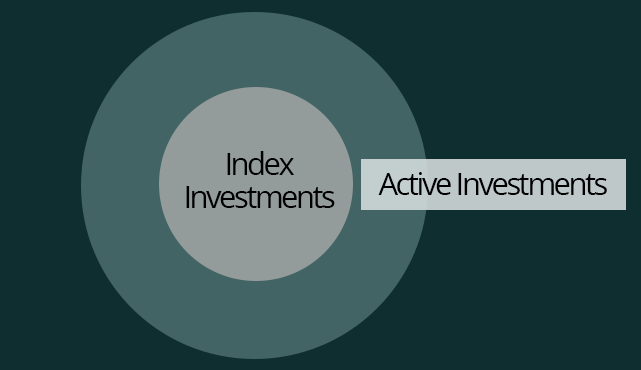

The Core Satellite approach

Many investors take a core satellite approach. A portfolio with a core satellite strategy has index investments at its core, with ‘satellite’ holdings that are actively managed. As an example, you may have 70% of your portfolio invested via index funds and 30% invested in active funds.

The key consideration when adopting this approach is to ensure the active managers within your portfolio have a level of ‘negative correlation’ with the index. Essentially, if an active fund manager’s portfolio is closely aligned with the index it’s unlikely that you’ll benefit from outperformance – it’s more likely that you will simply have a duplicate portfolio of assets that performs in much the same way.

As always, we recommend you seek professional advice about your personal circumstances.

We encourage investors to take a diversified approach that represents the level of risk they’re comfortable with and to ensure a long-term approach is taken.

To further discuss the impact that the issues in this article may have had on your investment portfolio, or to discuss making adjustments to your financial strategy, give our team a call for a confidential conversation regarding your personal circumstances

Are youready to take control of your financial future? If you answered yes, then we’re ready to assist.

With access to in-house experts in property, mortgages, tax and accounting, our holistic approach has your financial well-being covered. We’ll help you define your goals and prioritise what’s most important for your future and keep you on track.

If you would like to take control and activate your prosperity, contact our team on 1300 925 081 or via our contact form for a no obligation and confidential discussion.

Disclaimer:

While every attempt has been made to ensure the accuracy of this information at the time of compilation, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors or omissions (including responsibility to any person by reason of negligence) is accepted by Satori Advisory, its officers, employees, agents or representatives.

All contents presented within this document are not to be construed as personal financial advice, taxation advice, a recommendation or an offer or invitation to buy, sell or hold a financial product. It is for general informational purposes only. These indicative investment fees, comparisons and performance figures have been prepared without considering any personal objectives, financial situation or needs, and you should consider its appropriateness to your circumstances before acting on any of these representations.