We closed the 2018 calendar year with mixed results, with most market commentators sharing a negative outlook for 2019. While this may still be in store it’s been a very profitable start to 2019 for most. The Australian Share market (ASX200) ended 2018 on 5,646 and is currently flirting with 6,500 – values we haven’t seen since the lead up to the GFC. This was complimented by global shares, that had the best start to a year since the early 90’s, increasing by over 11%.

The positive start in January could be attributed to investors buying back in after a poor Dec 2018 quarter, or those who were previously sitting on cash investing in businesses they felt now represented fair value. February brought good news from the US in the form of encouraging talks with China and the Fed, who indicated their plans for rate increases had been put on hold. March was a fairly flat month as investors took a ‘wait and see’ approach.

The longevity of this rally is now the key question, as opposed to ‘how long will it continue’. There are some key events on the horizon that will likely determine whether profits made in the first quarter are maintained, extended or lost.

Locally we have the housing and lending environment, the RBA (with a rate cut now more likely than unlikely) and the aftermath from the Federal election playing a major role in driving investor sentiment. Financial markets have reacted positively to the election results, adding 1.5% in the first few hours of trading.

Internationally we have Brexit in the UK and Europe and, in May, we’re learning that more volatility is in store for markets from the US-China trade negotiations.

Fund in the Spotlight:

The Vanguard Global Infrastructure Index fund, as the name suggests, invests in essential assets such as toll roads, airports, rail and utilities. Infrastructure assets can provide investors with steady income combined with solid investment performance. Combined with a low correlation to traditional equity markets (meaning they can behave differently to the broader market) infrastructure investment is gaining popularity. As these assets represent physical resources that people interact with daily (and rely on as part of everyday life) portfolio managers often look to invest in infrastructure businesses as a ‘safe haven’ when financial markets are turbulent.

As a subsequence, appetite for listed infrastructure has increased in recent years. Morningstar data suggests that allocations within multi-asset funds have grown by 400% over the past 5 years (2018). These asset types are also increasingly popular with Industry Funds in Australia.

Our portfolios have always had an allocation to infrastructure that we feel is appropriate for the long term, topping 10% in more aggressive models. This strategy is designed to provide our clients with greater diversification but also to take advantage of the stability from both an income and capital growth perspective:

Over the past 12 months the fund has outperformed expectations by a considerable margin, providing our clients with an exceptional 27.27% return in the year leading up to 31 March 2019. The fund provides this exposure in a low-cost environment, with a management fee of only 0.49%.

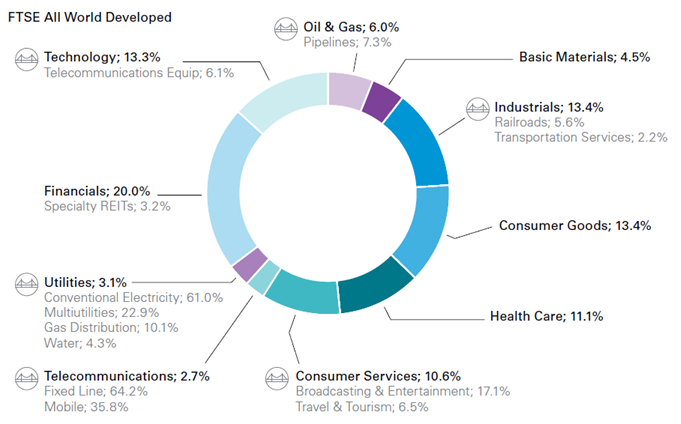

Infrastructure isn’t a single sector approach

Assets held by an infrastructure fund wouldn’t typically represent a substantial holding in an international share fund, translating to minimal correlation with single sector International Shares funds.

Having diversification across asset classes, that behave differently in varying environments, is often beneficial as one asset class may offset losses in another.

In the March quarter of 2019 however, investors benefited from positive gains from Infrastructure, International Shares and Australian Shares.

As the fund is not hedged (against the Australian Dollar) investors also benefited from an increase in the value of the American dollar.

The following page provides an overview of the funds top 10 holdings. This includes the production of sustainable energy production – an approach we hope increases as green energy becomes easier to adopt from a commercial perspective.

If you’d like some advice on infrastructure assets and their role in your portfolio of investments get in touch with the team today on 1300925081.

Disclaimer:

While every attempt has been made to ensure the accuracy of this information at the time of compilation, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors or omissions (including responsibility to any person by reason of negligence) is accepted by Satori Advisory, its officers, employees, agents or representatives.

All contents presented within this document are not to be construed as personal financial advice, taxation advice, a recommendation or an offer or invitation to buy, sell or hold a financial product. It is for general informational purposes only. These indicative investment fees, comparisons and performance figures have been prepared without considering any personal objectives, financial situation or needs, and you should consider its appropriateness to your circumstances before acting on any of these representations.