In this update we explore the US share market and why it’s bucking the global trend of below average performance.

Brief Summary on the September 2020 quarter:

- COVID-19 continues to impact the world-wide economic recovery with imbalanced progress across the globe.

- Countries with less stringent lock-down procedures (US, for instance) are benefiting from greater economic activity (but is this sustainable?)

- International trade is improving after the lows of the first quarter.

- The economic response from Governments continues to impact the share market, particularly in the US where the long-awaited fiscal stimulus bill is yet to reach bipartisan agreement.

- The second wave of COVID-19 in Europe will delay the share market recovery. Europe as a region has not benefited from investor confidence as much as the US and locally in Australia.

- The lead up to the US election will continue to impact markets. For the next few months investors are ‘bracing for impact’. For some investors and business owners a Trump exit will be seen as a short term negative. In contrast to Trump, Joe Biden has indicated an increase to company tax rates, however he is pro stimulus and committed to improved foreign relations.

- The outcome that is expected to create the biggest market impact would be a Democratic ‘trifecta’ where the Democrats get the Whitehouse, Senate and The House of Reps, which will likely result in more radical reform.

Global share markets – where are we now?

Below is the market returns across the global from 1 January 2020 – 30 September 2020.

The US share market

COVID-19 has led the world economy into it’s deepest recession since the 1930’s. Unemployment is high, Government debt is skyrocketing and central banks across the globe are working hard to stimulate their economies – so why hasn’t this doom and gloom impacted the US share market in equal measure?

There may not be a single answer to this question, but the below may provide some clues and potentially some confidence:

- Money is “cheap” – Interest rates are near zero, enabling businesses to borrow to invest in technology, equipment, and people. Lower interest rates also mean more cashflow for individuals, many of whom may decide to invest their newfound savings for the longer-term.

- Government stimulus has also enabled impacted businesses to continue to operate and, in some cases, make purchases they wouldn’t otherwise consider.

- Businesses at the bigger end of town are relying less on people to operate profitably, minimising the disruption of their overall workforce.

- Individuals are using their Government stimulus funds to purchase goods and services from a disproportionate number of larger businesses. Technology such as phones, tablets, TV’s and computer equipment are driving demand. Tech businesses have also experienced a greater engagement with their audience since March, with more ‘screen time’ being a natural biproduct of the restricted movement in our population.

- Investors understand that while COVID-19 has been tough, there’s an end in sight. Whether this end is due to a vaccine or better management, most believe we’re not dealing with an issue that will cause a long-lasting recession or depression as seen in the world wars.

- Lastly and very importantly, we must remember that share market prices are actually the forecasted value of future cash flow, whereas Economic indicators and GPD are indicators of the current situation which may impact our future cash flows. These two measures do have a relationship, but their correlation often adjusts.

The below table shows companies in the US and Australia whose share prices have increased since the low-point of the COVID-19 crisis and highlights their swift recovery, owing to some or all the above considerations.

Important note on market capitalisation: Market cap—or market capitalisation—refers to the total value of all a company’s shares. It is calculated by multiplying the price of a stock by its total number of outstanding shares. For example, a company with 20 million shares selling at $50 a share would have a market cap of $1 billion.

Businesses with a higher market cap have a significantly bigger influence on the index they are listed on. They are also the most purchased businesses due to the lower risk that this size often brings.

One good example is Apple, whose market cap recently exceeded $2 Trillion USD.

To put this into perspective, the total value of Apples shares:

- Recently came close to exceeding the value of every company listed on the FTSE100 (UK index: 100 of the biggest listed companies in the UK).

- Is more than the GDP of several large countries including Italy, Brazil, Canada and Russia.

Apple represents almost 6.7% of the S&P500. Collectively, the below businesses (who have experienced an exceptional recovery) represent 18% of the S&P500. So when we look at the logical success of the below stocks, the US market’s strong return look a little more plausible.

| COMPANY / % OF THE S&P 500 | SHARE PRICE 23 MARCH |

SHARE PRICE 30 SEPTEMBER |

DIFFERENCE (%) |

| Apple* (6.7%) | $56.1 | $115.8 | 106.5% |

| Amazon* (5.0%) | $1,902.8 | $3,148.7 | 65.5% |

| Google* (3.2%) | $1,054.1 | $1,465.6 | 39.0% |

| Facebook*(2.3%) | $148.1 | $261.9 | 76.8% |

| Dell* | $33.9 | $67.7 | 99.4% |

| Netflix* (0.8%) | $360.27 | $500.03 | 38.8% |

* Price expressed in US Dollars

While the above ‘mega businesses’ are listed in the US, their clients and infrastructure are so embedded internationally that they’ve become a household name in every corner of the globe.

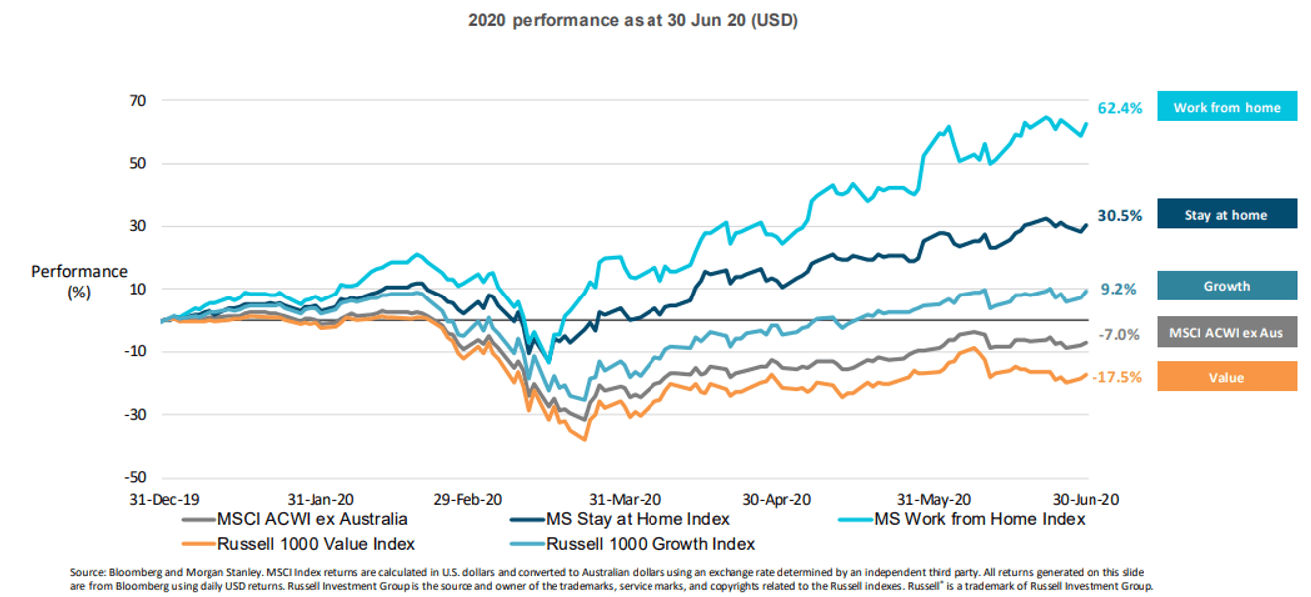

Refer the below returns to 30 June, showing the extreme differences in returns across industries, with ‘work from home’ companies like Apple and Zoom leading the way, followed by ‘stay at home’ companies like Netflix and Amazon.

How is this environment impacting our portfolios?

One of the fundamental principles of our investment philosophy is discipline. We believe sticking to an agreed asset allocation has a huge impact on long term returns, and the research agrees. While the road to recovery may still prove bumpy, our dedication to an agreed asset allocation throughout this period has helped many of our clients navigate the emotional rollercoaster and benefit from the sharp recovery over last few months.

As a result, the majority of our client’s portfolios are now in positive territory. Over the past 12 months we’ve had positive returns from International Shares, Fixed Interest and one of our active managers operating in the Australian Shares space (achieving a 12.04% in the 12 months to September 2020).

Australian Shares, Global Infrastructure, European Shares and Property Securities haven’t bounced back as quickly. As the world learns how best to deal with COVID-19 we’re hoping that businesses operating in these sectors recover in a timely fashion. While we wait for the longer term returns, we are rewarded with investment yields that far outweigh cash rates.

And finally, some news: We’re going green!

We’ve heavily invested in ESG Investing (Environmental, Social and Governance) and SRI (Socially Responsible Investment).

We will be adding portfolios that target investments that meet a strict environmental and social filter.

We believe everyone has an opportunity to help the environment and we’d like to invest into listed companies who include these types of considerations in their decision making. Research has shown these companies are expected to perform as well or better than their peers as these ethical principles are echoed throughout their business. In short, investing in companies looking to make a positive impact doesn’t need to come with a trade-off in returns.

For many this approach is a new one. While ethical investing is rapidly gaining popularity, many fund managers are jumping on the bandwagon and promoting ‘green’ as a tick box exercise. We are committed to developing a portfolio that makes a real impact while not forgoing returns or increasing risk for our community of clients.

We are working towards releasing our first portfolios with a ‘greener approach’ in December 2020. If you’d like to learn more feel free to register your interest via email at info@satoriadvisory.com.au.