We all know what it feels like to be in a comfort zone. Many of us live there, rarely pushing the boundaries and enjoying the familiarity and ease of decision making that creates our status quo.

But what happens when you aspire to be more, do more or achieve more than your status quo? Is it still possible from inside your comfort zone?

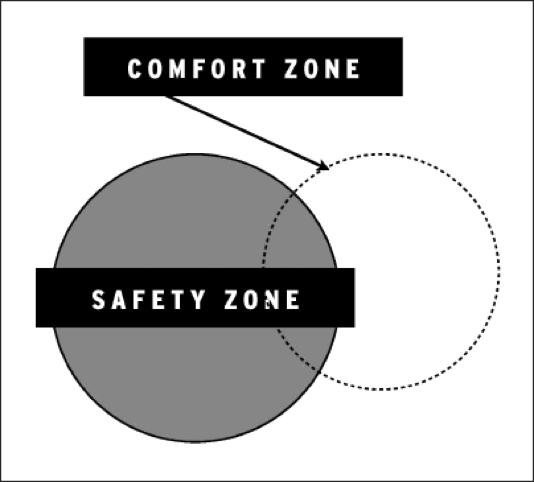

In what’s been dubbed his most inspiring book yet (The Icarus Deception), critically acclaimed author and entrepreneur Seth Godin, creates a distinction between a ‘comfort zone’ and a ‘safety zone’. While they may feel like the same thing, they are actually very different.

“We settle for low expectations and small dreams and guarantee ourselves less than we are capable of. The path that’s available to each of us is neither reckless stupidity nor mindless compliance. We’ve built a world where it’s possible to fly higher than ever, and the tragedy is that we’ve been seduced into believing that we ought to fly even lower instead.”

– Seth Godin, The Icarus Deception

When operating from a comfort zone, a person engages in activities and decision-making that feels natural and comfortable. Despite whether or not the activities work in their favour, the person continues to act that way because the perceived risk is minimal. This status quo behaviour can continue for decades.

The safety zone, on the other hand, is constantly changing. Influenced by the surrounding environment and the opportunities available in the marketplace, the safety zone represents a space where risk is probable but danger is unlikely.

When comfort zones and safety zones don’t align

Image sourced from Seth Godin’s The Icarus Deception.

Often in our younger years, comfort and safety zones align. We push the boundaries on what feels comfortable and rarely make decisions that are too risky. However, over time, the boundaries of the safety zone move. What may have been considered a poor decision ten years ago may be worth reconsidering now but because the comfort zone has become the default, we wrongly believe that what feels comfortable is also making us safe.

For example, you may aspire to have more money in savings and superannuation and less in mortgage debt. You may dream of building wealth by investing in the share market or property. Or you may have always wanted to start a small business, with a little capital to get things going.

However, working from a place of comfort, these aspirations may not have materialised. Instead of constantly re-evaluating whether a decision was “safe”, you retreated into a place of comfort. But did you know that staying in this status quo could work out riskier than the perceived risk of leaving your comfort zone?

Take the home loan market for instance. If switching banks to get a better deal on your home loan was too far outside your comfort zone, you may have avoided it. Today, the consequence of that inaction could be that you missed out on lower interest rates and ended up paying tens of thousands of dollars more over the life of the loan. Even a 0.5 percent lower interest rate can save over $50,000 on a $600,000 mortgage over the life of a typical loan, which means the cost of inaction is high.

In terms of your superannuation, making a small adjustment today by finding a more cost effective fund with better return prospects could bring forward retirement by half a decade. For example, if you have $100,000 in superannuation today with annual contributions of say $10,000 every year, improving net returns by two percent per annum can give you $200,000 more in the next 20 years.

How to get realigned

Godin says that “success quite often favours those who have adjusted their comfort zones.” This means that if you aspire to be more, do more or achieve more than your status quo, it may be time for a re-alignment.

But how do you know if your safety zone and comfort zone are aligned? The best way to find out is to work with an experienced financial adviser who will evaluate your current financial situation, understand your financial goals, and present you with opportunities and strategies to help you achieve them. A good adviser, backed with the right facts and experience, will be able to identify your fears, biases and start to challenge your assumptions. They may present options that are outside your comfort zone. If they do, you can consider whether they are inside your safety zone and shift your comfort zone accordingly.

Changes and being put in a position to make some tough decisions may feel a little stressful and take time to adjust. However, consider the alternative: if you don’t change, you will inevitably perpetuate your status quo. Even worse, you may miss out on key opportunities that carry very little risk and provide exceptional rewards as you move into your future.

Signs you might be in a financial comfort zone

Asking yourself the following questions can help to determine whether you are in a financial comfort or safety zone, and assess your readiness for change.

- Is doing what you’ve always done with your money, or perhaps not making any decisions at all, truly living in your safety zone? When your alternative may be to define what wealth target you need and step out of your comfort zone to work with an adviser to map out the actionable steps to get there.

- Is it safer to listen to the headline-grabbing media who are paid to evoke fear, confusion and concern – especially when it comes to property and superannuation? Or would it be better to focus on learning the fundamentals of wealth creation?

- Is your current superannuation fund capable of funding the retirement you want? Is it more comfortable to just assume ‘they are all the same’? Would it be safer to find a fund that has more efficient pricing and better insurance?

- Do you prefer to keep all your investments in cash for long periods of time, even though many cash rates aren’t keeping up with inflation? Is it safe or perhaps just comfortable to avoid short term volatility at the expense of long term capital growth?

To find out how we can help you shift your comfort zone and help you do more, be more and achieve more with your finances, call Satori Advisory today on 1300 925 081.

About the author

Tim Hobart is Managing Director of Satori Advisory. Located at our Sydney office Tim has a Bachelor of Commerce, a Graduate Diploma in Financial Planning and is a Certified Financial Planner (CFP). With over 15 years’ experience providing Accounting, Taxation and Financial Planning services, Tim has grown a reputation as an Adviser and Business Owner with uncompromising standards, focussed on delivering an exceptional experience for his valued clients.

Tim Hobart can be contacted on 1300 925 081 or by email on info@satoriadvisory.com.au

All contents presented within this document are not to be construed as personal financial advice, taxation advice, a recommendation or an offer or invitation to buy, sell or hold a financial product. It is for general informational purposes only.

While every attempt has been made to ensure the accuracy of this information at the time of compilation, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors or omissions (including responsibility to any person by reason of negligence) is accepted by Satori Advisory FP, its officers, employees, agents or authorised representatives.

Investing in financial products comes with inherit risk and it may not be right for you. Talk to a Satori Advisory adviser to see how we can help you.